Source: Wikipedia.org

M1: The total of all physical currency part of bank reserves + the amount in demand accounts ("checking" or "current" accounts).

M2: M1 + most savings accounts, money market accounts, retail money market mutual funds,and small denomination time deposits (certificates of deposit of under $100,000). (A key economic indicator of inflation.)

M3: M2 + all other Certificate of deposit (CDs) (large time deposits, institutional money market mutual fund balances), deposits of euro-dollars and repurchase agreements.

Source: Inflationdata.com

Following the theory of the Austrian economists who measure the inflation by calculating the growth of what they call 'the true money supply', how many new units of money that are available for immediate use in exchange, that have been created over time.

This interpretation of inflation implies that, within a centralized banking system, inflation is always a distinct action taken by the central government or its central bank, which permits or allows an increase in the money supp, including bank credit as a contributor to inflation.

In the US, the value of bank credit generated by private financial institutions and held within checking accounts currently rivals the value of the bills and coins "printed" by the Federal government, and has, at times, significantly exceeded the value of printed money. In addition to state-induced monetary expansion, the Austrian School also maintains that the effects of increasing the money supply are magnified by the credit expansion usually performed by private financial institutions as a result of the fractional-reserve banking system permitted in most economic and financial systems in the world.

Austrian School economists claim that the state uses inflation as one of the three means by which it can fund its activities. In other cases, the central bank may try avoid or defer the widespread bankruptcies and insolvencies which cause economic recessions or depressions by artificially trying to stimulate the economy through encouraging money supply growth and further borrowing via artificially low interest rates.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.”

"It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

Henry Ford

Henry Ford

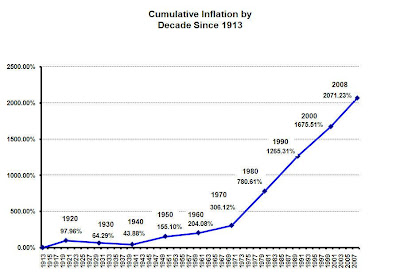

The devaluation of the Dollar:

Source: Oustanding Investment

This figure shows that the money supply skyrocketed while the dollar value plunged by 96% thus plummeting the purchasing power.

In 1971 you could buy a house for $50,000 then and, just on an inflation basis, it would be worth $350,000 today, and back then, you could retire on $270,000 in savings and it would be as good today as being a millionaire.

The enemy of the Fed is a dead and stagnant economy, the deflation, an economy in which nothing moves and nobody buys a thing.

Therefore the Fed secretly fights to hold it off desperately every single day, by flooding the market with cash and easy credit. Because regular cash and credit injections make everyone feel rich.

The theory goes, when you've got cash and low-priced credit, companies borrow and expand. Consumers borrow and spend. Families borrow and buy homes.

Note that now we are exporting some of our inflation to China as they send us goods and buy our debt.

The Fed Chairman Ben Bernanke famously said in a speech at the National Economists Club in Washington, in November 2002:

“Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology called a printing press (or, today, its electronic equivalent) that allows it to produce as many U.S. dollars as it wishes at essentially no cost... We conclude that under a paper money system, a determined government can always generate higher spending and, hence, positive inflation.”

In other words, if you want to juice an economy... turn on the printing presses and make it as easy as all get-out to borrow money at a low, low rate of interest.

And Ludwig von Mises, the famous economist said:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of the voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

The Bush administration, with full knowledge of the implications of a credit disaster, borrowed more money from 2000–2008 than every White House since the time of Washington!

“Economists agree this can’t go on. We can borrow and borrow, but eventually there will be a day of reckoning”

Joseph Stiglitz, former white house economist

The dollar's worth today is just pennies compared with what it bought a century ago.

In fact, its worth is just a fraction now, as we just demonstrated, the money supply had gotten so embarrassing that the Fed actually "retired" a number, "M3," which was the most broad-reaching measure of how much cash floats around in the system.The dollar's worth today is just pennies compared with what it bought a century ago.

No comments:

Post a Comment