Four Indicators:

- Gold

- U.S. T-bonds

- The VIX Index

- U.S. Dollar Index (USDX)

When these four indicators are all together in a up trend, you know that the market is getting dangerous!

Gold:

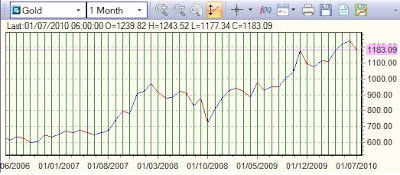

The gold price per troy ounce went from $37 in 1970 to $1,183 in 2010 (July 19th) so an increase of 3,097%!

Since the last ten years we are in a bullish trend.

Gold should reach the $1,350/oz before the end of 2010 and $1425/oz in 2011 (Goldman Sachs).

As we all know gold is a good hedge against any economic, political, social or currency-based crises (national debt, inflation,weak U.S. dollar, war…).

U.S. T-bonds:

When the interest rates decrease the iShares Barclays Capital U.S. 20+ Year Treasury Bond index increase (The fund generally invests 95% of assets in U.S. government).

In each Financial Crisis investors protect themselves by investing in U.S. T-bonds.

Why? because it's the largest treasury bond market and the most liquid in the world, and investors trust the U.S. government which remain the world's superpower.

The VIX Index:

The VIX Index is the Chicago Board Options Exchange Volatility Index, a popular measure of the implied volatility of S&P 500 index options. It is not backed by anything and positions held are merely a prediction of a future. A high value corresponds to a more volatile market and therefore more costly which can be used to defray risk from this volatility by selling options.

Often referred to as the fear index, it represents one measure of the market's expectation of volatility over the next 30 day period. When the VIX Index goes up investors buy options to hedge their portfolios against a bear market (High VIX Index = Bear Market).

And these last days we can see that the VIX Index restart to goes up...

U.S. Dollar Index:

The U.S. Dollar Index (USDX) is an index which measures the value of the United States dollar relative to a basket of foreign currencies (the majority of its most significant trading partners). (Euro (EUR), 57.6% weight, Japanese yen (JPY), 13.6% ,Pound sterling (GBP), 11.9%,Canadian dollar (CAD), 9.1%, Swedish krona (SEK), 4.2% and, Swiss franc (CHF) 3.6%.)

Each time that the Euro zone equity markets are in red, the U.S. dollar goes up.

Why? because investors repatriate their capital (by selling their assets in euro, pounds, and yen and by rebuying assets in U.S. dollar like the T-bonds).

And we can see that now investors are leaving the Euro zone and the yen by reinvesting in U.S. dollar assets, the USDX Index:

To sum up, if you follow these four indicators you will be able to estimate the market trend and its volatility.

Right now the thermometer is going up, you have to be careful, if you have invested in equities or commodities review your stop market orders.

And I think that today it can be a good strategy to invest a part of your portfolio in gold...

Follow the market when the fever will go down, many investment opportunities will show up.

No comments:

Post a Comment